Get FREE Medicare Help in Florida and Texas

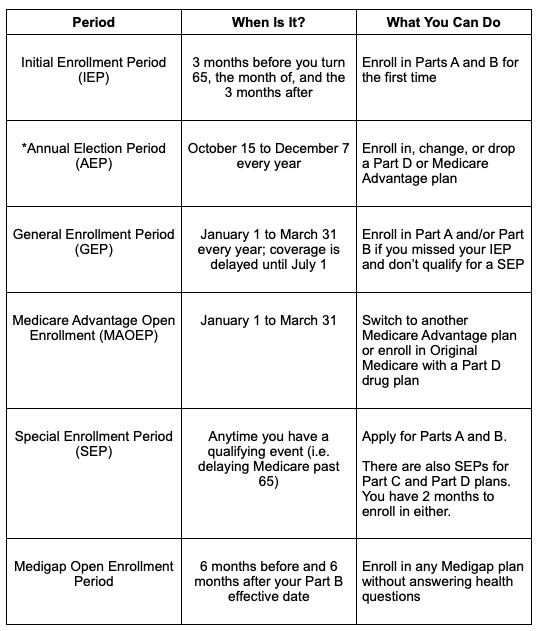

Medicare is a maze. You may find yourself quickly approaching 65, the magic number when you become eligible. With that comes a load of information about Medicare and its parts. You might be searching for answers on what exactly Medicare is, how it works, and how to choose the right plan. That’s where we come in.

Lacayo Group Insurance is here to educate you on all things Medicare: the different parts, enrollment periods, penalties, and much more. This is a new journey that you don’t have to go through alone — our licensed Florida agents will walk alongside you and guide you through the process.

What Is Medicare?

Medicare is a national health insurance program for people 65 and older, and under 65 with certain disabilities or end-stage renal disease (kidney failure).

The history of Medicare goes back to 1965, when President Lyndon B. Johnson signed a bill into law so that eligible people could get the health coverage they needed from a federal government program. At first, the coverage was restricted to Part A and Part B.

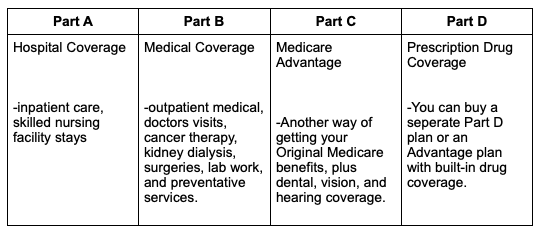

The coverage has evolved over the years to cover more people, and now, more than 50 million people are on Medicare. While Parts A and B (called Original Medicare) will provide coverage for 80% of your expenses, there are supplemental policies that you can buy to help with the other 20%.