Medicare Part B Is Your Medical Insurance

Some people get Part B automatically, and others will need to sign up.

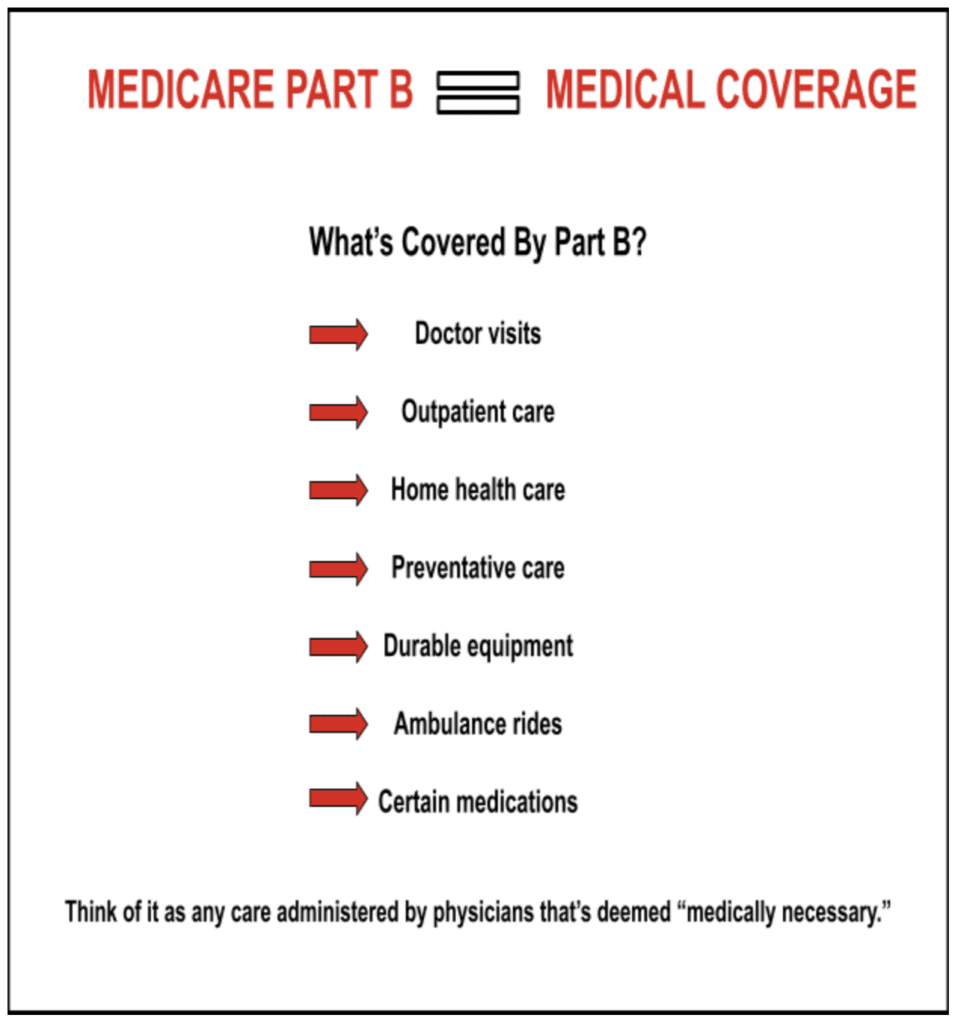

Medicare Part B — medical insurance — helps pay for doctors services, ambulance services, outpatient care, durable medical equipment, home health care, and some preventative services.

Lacayo Group Insurance is here to educate and answer common questions about Medicare Part B.

Define Preventative Care?

Preventative services are health care to prevent illness, such as the flu, or detect it as early as possible. Treatment will likely work best during the early stages of an illness.

If you get the care from a provider who accepts assignment, you pay $0 for MOST preventative services.